Hello, guys.

You made it. You survived Covid and being kicked off campus halfway via spring of your freshman 12 months. You survived a 12 months of Zoom. You survived that bizarre casserole the eating commons stored serving. You survived me. And, on the finish of it, you have been standing collectively, laughing and glowing. We’re extremely happy with you and eager for the great you are able to do on the planet.

I’ve by no means aspired to ship a “final lecture” for graduates, however you would possibly take into account this as my final recommendation earlier than you sail too removed from the protected harbor we’ve supplied. Right here’s the gist of it:

Don’t let cash rule your life. Cash is only a instrument that will help you stay a life that can make you are feeling engaged, safe, and happy. Cash shouldn’t be the thing of life. Don’t obsess about it.

That has two elements: (1) stay a acutely aware, frugal life. Purchase what you want, not what you need. Spend cash on experiences and time with pals. And (2) use cheap frugality as a method to construct safety. That’s, in the long run, you’re higher off spending rather less and placing apart a bit extra as a result of, when push involves shove, your wants will probably be modest, and your sources will probably be wealthy.

Let me stroll you thru that.

A younger investor has one nice enemy: inflation.

We frequently consider inflation’s concrete, every day manifestations: a medium latte (they will name it “grande” if they need, however it’s “medium”) is 4 bucks, and a “one pound can of Folgers” now weighs 9.6 ounces. As if to reassure you, Cheerios now is available in MEGA SIZE (21.7 ounces), GIANT-SIZE (20 ounces), FAMILY SIZE (18 ounces – don’t blame me, the all-caps factor is their concept), LARGE SIZE (12 ounces) and, I suppose, common dimension (8.9 ounces). Common interprets to 6 wimpy bowls of cereal.

For an investor, inflation is an insidious enemy that chews your financial savings to bits. Inflation sits at about 3%. Deposit $100 in a financial savings account right this moment (when you get previous the teaser charges and asterisks, banks pay 0.05% on financial savings right this moment), and it’ll purchase $75 value of stuff in 10 years. $56 value of stuff in 20.

A younger investor has one nice ally: time.

The American financial system and its inventory market have grown relentlessly for 150 years. Within the brief time period, there are horrifying setbacks. Within the medium time period, there are flat durations. However in the long run, there’s relentless progress, after inflation is accounted for, of about 8% per 12 months. Right here’s what that appears like: when you simply put $100 into the market and stroll away, then what occurs when you funds $100 a month ceaselessly?

| Beginning worth of $100 | Inflation-adjusted return | Actual return when you add $100 / month |

| 10 years later | $215 | 18,300 |

| 20 years later | 466 | 57,700 |

| 30 years later | 1006 | 142,300 |

| 40 years later | 2176 | 326,000 |

“Actual return” is the quantity you’ve after accounting for the results of inflation. Your “nominal return” is the quantity you’d see in your brokerage assertion. On the finish of 40 years, your account would have $564,000, however that may purchase the equal then of getting $326,000 right this moment.

By the best way, $100 in a financial savings account for 40 years leaves you with $30 in spending energy. Add $100 a month to that financial savings account, and at 3% inflation, you’d find yourself with $14,900 in shopping for energy.

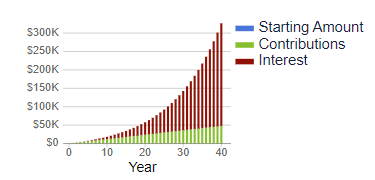

For visible learners, right here’s the mixture of beginning early, chipping in month-to-month, and making purely unusual returns within the inventory market.

Sure, I do know. Pupil loans. New condominium. Work garments. Right here’s your plan: you’ll get critical about investing in 10 years once you’ve paid off your loans and such. Right here’s the worth of surrendering ten years to inflation:

Sure, I do know. Pupil loans. New condominium. Work garments. Right here’s your plan: you’ll get critical about investing in 10 years once you’ve paid off your loans and such. Right here’s the worth of surrendering ten years to inflation:

Begin now: finish with $326,000

Begin in 10 years: finish with $142,000

Begin now, and it takes $100/month to hit $326,000 in 40 years. Beginning in 10 years, it’ll take $220 a month for the following 30 years. Begin now, and $48,000 in lifetime contributions will get you $326,000 in actual returns. Wait a decade, and it’ll take $84,000 to get you there.

Are you able to think about how joyful you’d be to someday look in a shoebox below the mattress and uncover $564,000 in it? That’s what you’re able to.

Don’t wait.

The three-step plan

Keep away from silly consumption.

You realize that is my specialty (Comm 240 / Promoting and Shopper Tradition for the previous 30 years) and my ardour. Collectively, entrepreneurs and advertisers within the US spend about $500 billion a 12 months attempting to get you to purchase s**t you don’t want. Right here’s the ugly fact: when you truly wanted it, they wouldn’t must spend a half trillion {dollars} to inspire you.

Don’t purchase from Shein. Their stuff is designed to final solely two or three makes use of earlier than being landfilled. The common Shein shopper spends… look forward to it! $100 a month on disposable clothes on that website.

Don’t subscribe to Amazon Prime. The fee retains going up, and so they’re enjoying danged intrusive adverts on their motion pictures. Amazon Prime tips you into impulse purchases you’d by no means make when you needed to pay an affordable delivery price. The common Amazon Prime subscriber spends $1400 a 12 months at Amazon, greater than twice what different folks do. Together with the Prime price, you’re prone to sink $1550 a 12 months into the Bezos Machine. Don’t.

Don’t purchase a high-end cellular phone. We each know that you simply hate being hooked on them. That’s $1599 to have your life sucked away, pixel by pixel. You’d take pleasure in life much more with a flip telephone/dumb telephone/function telephone at $90. In case your telephone is sufficiently boring, you could be pressured to, , cease phubbing, meet folks and discuss with them. And, who is aware of, perhaps have intercourse? 35% of smartphone customers admit that their love lives have kind of … shriveled.

Don’t purchase an SUV. Ever. SUVs and the issues that was pickup vans are 80% of latest automobile gross sales within the US. They’re large, unwieldy, unsafe, and loopy costly. They common $38,000 … and that’s earlier than you consider mortgage funds. The revenue margin on an SUV is 5 occasions larger than on a automobile. They’re promoting you a fantasy about domination and freedom and nature. Dude, you’re simply going to the mall. Improve your fantasies, downgrade your automobile.

Don’t purchase a brand new automobile. Ever. Nothing falls sooner in worth than a brand new automobile. The common worth of a brand new Camry (my automobile) is $30,000. A year-old Camry runs $25,000. A two-year-old is round $23,000. With cheap care, a Camry lasts 12-15 years. In case your automobile mortgage is 48 months, you get 8-11 years and not using a automobile cost.

Don’t default to residing in a stylish metropolis. A lot of America’s housing disaster is pushed by the insistence that you simply actually, actually, actually need to stay in Phoenix (common home: $480,000, common July excessive: 104 levels), Dallas ($370,000 and 97 levels), Denver ($550,000, 84 levels) or Chicago ($370,000, 86 levels). Think about Inexperienced Bay ($250,000, 80 levels), Pittsburgh ($217,000, 84 levels) or the Quad Cities ($170,00, 86 levels). And earlier than you say something foolish, there are good jobs and attention-grabbing issues to do there. Smaller cities are usually extra inexpensive, typically supply a greater high quality of life … and lots of are situated exterior the Furnace Zone.

Open a brokerage account at Schwab.

It takes about ten minutes, a replica of your checking account data, and just about no psychological exercise. After you have an account, set it as much as mechanically switch, say, $100 out of your checking account to your Schwab account across the first of every month.

Actually. Ten minutes.

Create a low-stress funding portfolio, then get on with life. Normally, you need boring investments. Lethal uninteresting stuff that you simply by no means want or need to take a look at. Attention-grabbing investments are harmful, and thrilling investments are lethal. Two causes. First, since you’ll begin trying hourly and tweaking every day and screw your self by getting it unsuitable extra typically than you get it proper. Second, as a result of by the point you’ve realized about “the following massive factor,” one million different folks – together with tens of hundreds of predatory professionals with large honkin’ computer systems and high-frequency buying and selling algorithms – obtained there forward of you and have totally gamed the system.

No memes. No crypto. No AI. No positive artwork.

For the daring, an all-stock, all-the-time funding fund: GQG World High quality Fairness Fund. One of many world’s premier inventory buyers, Rajiv Jain, builds a portfolio of 40 distinctive corporations, which he purchases solely when the worth is nice. The fund has returned 16% a 12 months for the previous 5 years. Price to open an account: $100.

For the daring, preferring exchange-traded funds: GMO US High quality ETF, which is the primary fund for normal folks supplied by GMO. This ETF makes use of the identical course of used within the $10 billion, five-star GMO High quality fund, which has made 17% a 12 months over the previous 5 years. Two variations: the ETF solely invests within the US. And the ETF doesn’t require a $5 million minimal buy.

For individuals who actually simply need to begin a one-stop retirement fund, Schwab Goal 2060 Index. This ultra-cheap fund invests in a group of different index funds; that’s, funds that passively mirror the market moderately than attempting to outperform it as GQG and GMO do. It begins out by investing 95% of your cash in shares, however as retirement approaches, it turns into systematically extra conservative so that you’ve got much less threat of falling sufferer to a inventory market crash simply as you have been considering of retiring. Minimal buy: $1.

Lastly, for individuals who would actually favor to not lose a lot cash alongside the best way (inventory markets periodically trigger 25-60% of your funding to evaporate, which some discover disquieting), FPA Crescent combines absolutely the worth self-discipline that infuses the FPA operation with the willingness to put money into any half of a beautiful agency’s capital construction: frequent or hybrid fairness, debt, loans or no matter. The workforce’s emphasis is shopping for high-quality corporations plus a small set of intriguing, shorter-term alternatives as they current themselves. At base, absolutely the worth buyers say, “We’ll solely purchase if we’re providing a sexy safety priced with a compelling margin of security; absent that, we’re going to attend.”The fund has returned 11% a 12 months over the previous 5 years with dramatically much less threat than the market. Minimal funding: $100.

I’ve loved our time collectively. You have got made my life richer along with your depth, your silliness, your questions, and your goofs. They’ve stored me alert and cheerful. I hope these ultimate phrases do one thing comparable for you, younger Jedi.