What You Have to Know

- Some purchasers have the self-discipline to lock money away in extraordinary investments.

- The portfolio may crash on the worst time.

- The necessity for care may come sooner than anticipated.

Ought to my consumer Bob self-fund the long-term care threat or choose a hybrid long-term care coverage? He’s 67 and does have some well being points.

Since he’s an engineer and an accountant, and he’s pursuing his doctorate in AI, I positively anticipated insightful questions from him.

Certain sufficient, Bob despatched this thought-provoking e-mail: “Utilizing the $6,500 profit for 4 years and assuming the assured charge, my most profit is $563,053. If I make investments the one-time premium at 5.59% for 20 years in a high-grade bond, I can get the identical quantity.”

My Preliminary Ideas

As long-term care advisors, we all know that in an ideal world — with an correct crystal ball to foretell the longer term — it could be nice if a consumer may predict when they are going to want care.

Sadly, we can not rely on that taking place.

The way in which I see it, the “self-funding” technique is vulnerable to 3 large dangers:

- A lower-than-expected charge of return.

- Larger-than-expected tax charges at declare time.

- The shortcoming to achieve the 20 years of wanted development to construct the ‘LTC self-fund’ account.

Any one of many three outcomes — or perhaps a mixture — and the self-funding technique could also be insufficient.

That might depart our purchasers with the monetary dilemma of the way to pay the excessive care prices, which might vary from roughly $60,000 a 12 months for house care to over $108,000 for nursing house care.

My Subsequent Step

To handle Bob’s inquiry and take a more in-depth have a look at the self-funding threat, I consulted Zack Derryberry, Hybrid LTC Director at ACSIA Companions.

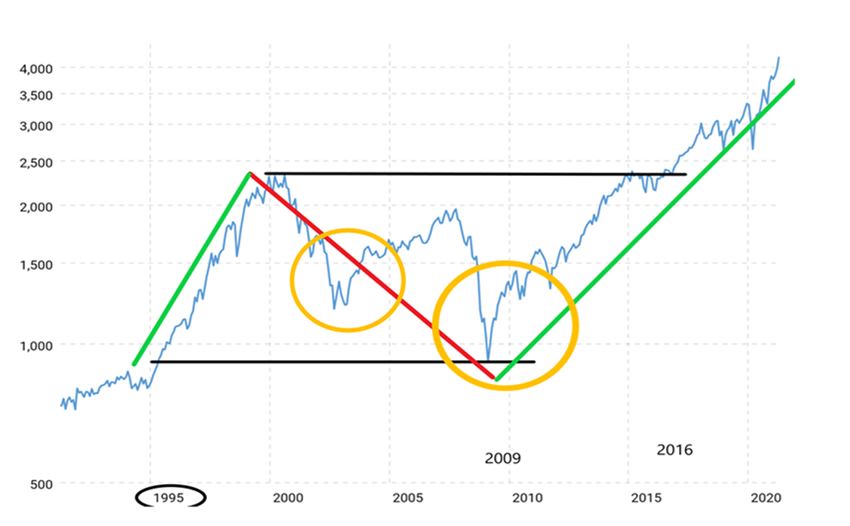

We checked out market efficiency beginning in 1995 and the way it could have labored for a consumer if the consumer had began self-funding 29 years in the past.

Zack supplied this chart to clarify a key threat of utilizing investments to fund LTC bills — lack of management over timing.

We used Joan as our instance.

- In 1995, at age 65, she decides to make use of investments to self-fund her future LTC prices.

- From 1995 to 2000, her technique seems to be prudent. The S&P 500 (the blue line on the left aspect of the chart) soars, rising her portfolio (the inexperienced line on the left).

- Nevertheless, the last decade of 2000 to 2010, with pure market functioning, brings volatility.

- Sadly, Joan experiences two LTC occasions (orange circles).

The primary LTC occasion is at age 73, and the second LTC occasion is at age 79.

Takeaway: Joan seemed nice for 5 years.

Nevertheless, as a result of her planning is delicate to the market, she now has far much less financial savings than anticipated to cowl prices.

And, in 2009, when she wanted care at age 79, she had solely about the identical sum of money she had in 1995, because of market downturns (the crimson line.)

Purchasers like Bob who hope to fund their LTC prices with a portfolio of fixed-rate bonds might also face the kinds of funding threat related to bonds, comparable to default threat, name threat and asset-liability matching issues.

The Dangers of Timing

Zack explains, “Since you’ll be able to’t predict once you’ll endure a change in well being which leads to struggling long-term care bills, a interval of market decline may depart you vulnerable to inadequate funding for LTC expense.”

This sort of monetary shortfall defeats the aim of self-funding.

The fluctuating worth of your consumer’s accounts — a typical market incidence — and an absence of management over the timing of a long-term care occasion — may depart your consumer ill-prepared and even in monetary issue.