L T Meals Ltd. – Farm to Fork

Integrated in 1990, LT Meals Ltd. is a worldwide shopper meals firm specializing in basmati and different specialty rice, natural meals, components, and ready-to-eat/ready-to-cook segments. It’s the main rice model in India and the No. 1 specialty meals model within the US, with flagship manufacturers like ‘Daawat’ and ‘Royal’. The corporate holds a market share of over 29% in India and practically 50% within the US basmati market, distributing its merchandise throughout 80+ international locations.

Merchandise and Companies

- Rice Portfolio: Consists of brown, white, steamed, parboiled, natural, and fast cooking brown flavored rice underneath manufacturers like Daawat, Royal, Heritage, Gold Seal Indus Valley, 817 Elephant, Devaaya, and Rozana.

- Natural Meals: Includes rice, soya, pulses, oil seeds, cereal grains, spices, and nuts.

- Rice-Primarily based Comfort Merchandise: Sauté sauces, cuppa rice, ready-to-heat merchandise, fortified rice, and rice-based premium snacks.

Subsidiaries: As of FY23, LT Meals has:

- 15 subsidiaries

- 3 affiliate corporations

- 3 joint ventures

Development Methods

- Established Model: Sturdy portfolio with manufacturers like Daawat and Royal; home market share at 30.1% with a quantity development of 11% in FY24.

- International Market Dominance: Increasing product portfolio and effectivity; important development within the US and Center East markets.

- Strategic Offers and Enlargement: Entered new markets and strategic offers, together with with SALIC and in international locations like Tanzania and Zambia.

- New Facility: Upcoming facility within the UK to reinforce manufacturing capabilities.

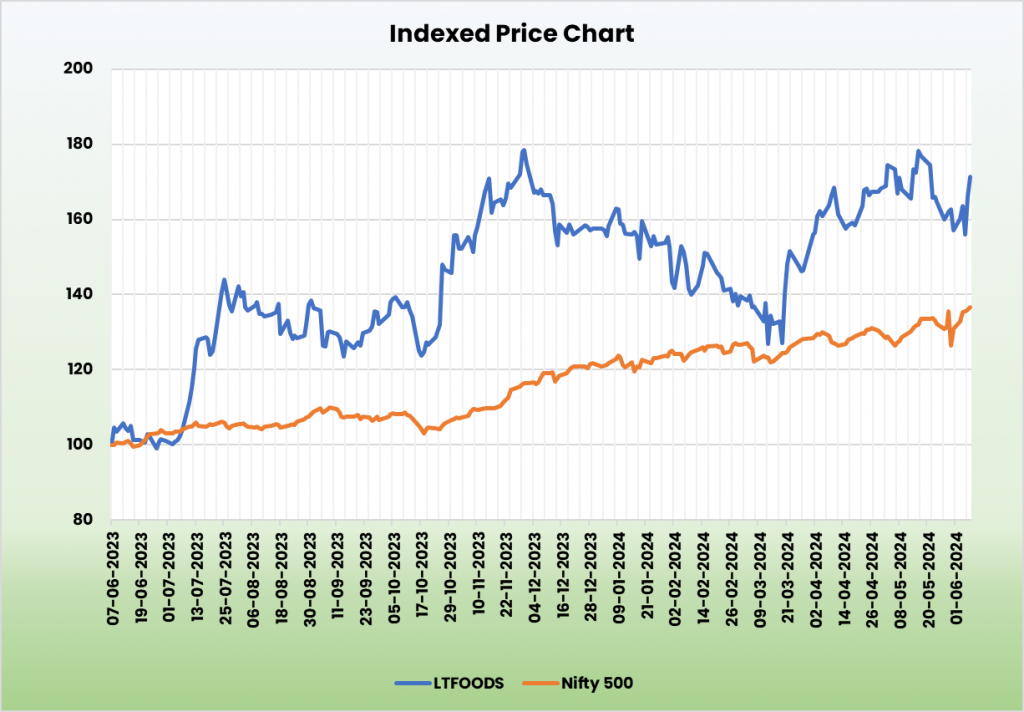

Monetary Highlights

Q4FY24

- Income Development: 14% YoY improve to Rs. 2,092 crore in Q4FY24 from Rs. 1,835 crore in Q4FY23.

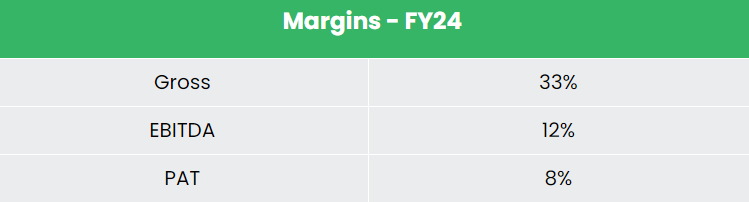

- EBITDA Enchancment: Grew by 25% to Rs. 262 crore in Q4FY24 from Rs. 210 crore in Q4FY23.

- EBITDA Margin Enlargement: Elevated by 110 bps to 12.5% on account of decrease enter prices, greater realisation, and normalised freight prices.

- Web Revenue Improve: 14% rise to Rs. 150 crore in Q4FY24 from Rs. 132 crore in Q4FY23.

FY24

- Income Development: ₹7,822 crore, a rise of 12% YoY

- Basmati and Specialty Rice Section: Grew by 17%

- Prepared-to-Eat and Prepared-to-Cook dinner Section: Grew by 23%

- Working Revenue: ₹988 crore, up 33% YoY

- Web Revenue: ₹598 crore, a rise of 41% YoY

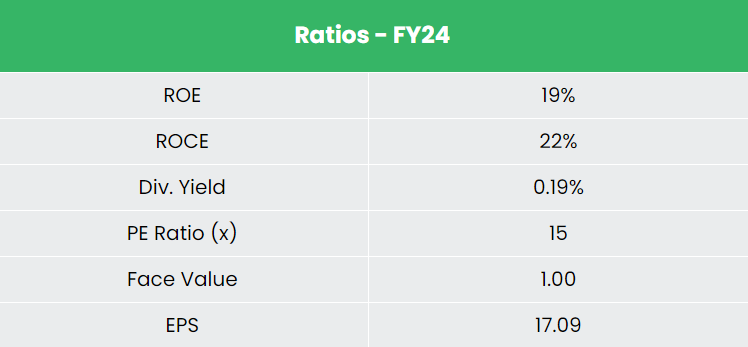

Monetary Efficiency (FY21-24)

- Income and PAT CAGR: 18% and 29% respectively, over three years.

- Common ROE and ROCE: Roughly 18% for FY 21-24 interval.

- Capital Construction: The corporate maintains a strong capital construction with a debt-to-equity ratio of 0.27.

Trade outlook

- The Indian meals processing sector is a precedence underneath the “Make in India” initiative.

- Accounts for 32% of the nation’s complete meals market, ranked fifth globally.

- Important potential for worth addition, with exports of 11.1 Mn Tonnes of non-basmati rice and 5.2 Mn Tonnes of basmati rice in FY 23-24.

- Rising demand for natural merchandise, anticipated to rise with a CAGR of 25.25% from 2022-27.

Development Drivers

- FDI: 100% FDI permitted underneath the automated route in meals processing industries.

- Price range Allocation: ₹3,290 crore allotted for the Ministry of Meals Processing Industries within the Interim Price range 2024-25, a 13% improve.

- Market Measurement: Projected to succeed in US$ 1,274 billion by 2027 from US$ 866 billion in 2022.

Aggressive Benefit

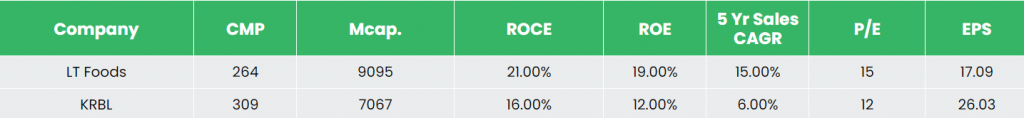

KRBL is the one listed competitor of LT Meals at a comparable market cap and vary of operations. LT Meals reveals greater return ratios and secure income development, indicating higher monetary stability and effectivity.

Outlook

- Model Presence: Deal with model constructing, innovation, and worldwide enlargement.

- Development Targets: Aiming for a 5-year income CAGR of 10-12%, with a plan to extend the 5-year EBITDA margin by 140-150 foundation factors.

- Return Ratios: Concentrating on ROCE of 23% and ROE of 20% by FY24-25.

- Challenges: Navigating points like anti-dumping obligation within the soya market and margin pressures from freight prices.

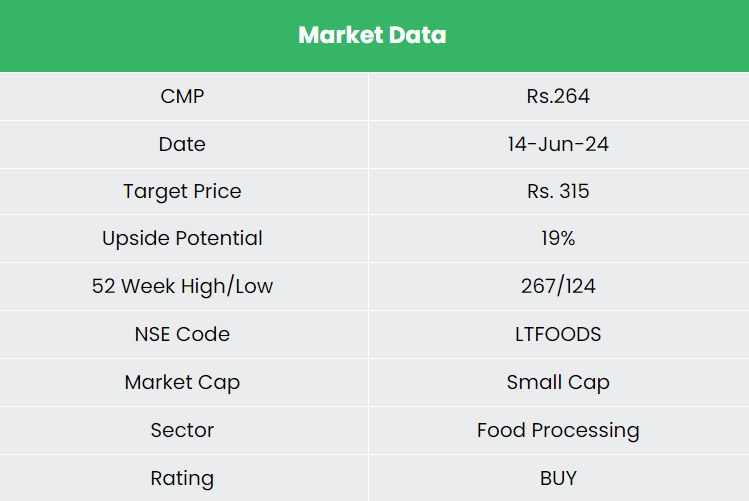

Valuation

LT Meals Ltd. has strong development prospects given its robust concentrate on strengthening manufacturers, distribution, and area & product diversification. We advocate a BUY score within the inventory with the goal value (TP) of Rs. 315, 11x FY26E EPS.

Dangers

- Foreign exchange Danger: Publicity on account of important operations in international markets.

- Socio-Financial Danger: Potential influence from socio-economic instability resulting in elevated enter prices.

Notice: Please observe that this isn’t a suggestion and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

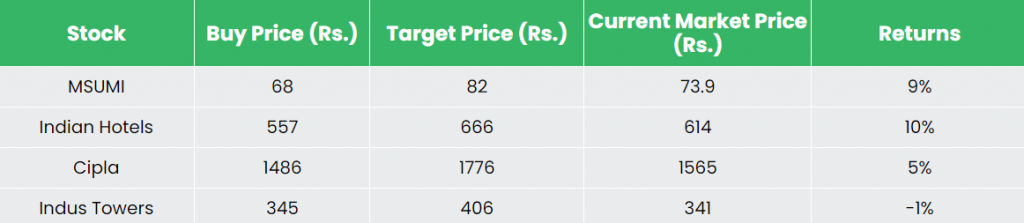

Recap of our earlier suggestions (As on 14 June 2024)

Motherson Sumi Wiring India Ltd

Different articles it’s possible you’ll like

Put up Views:

198