Indus Towers Ltd. – Connecting Lives Throughout the Nation

Shaped by the merger of Indus Towers and Bharti Infratel Restricted, Indus Towers Ltd. is among the largest telecom tower corporations globally. Included in 2006 and headquartered in Gurugram, the corporate supplies tower and associated infrastructure sharing companies. As of March 31, 2024, Indus Towers operates over 219,736 towers and 368,588 co-locations throughout all 22 telecom circles in India, serving main gamers like Bharti Airtel, Vodafone Concept, and Reliance Jio.

Product Portfolio

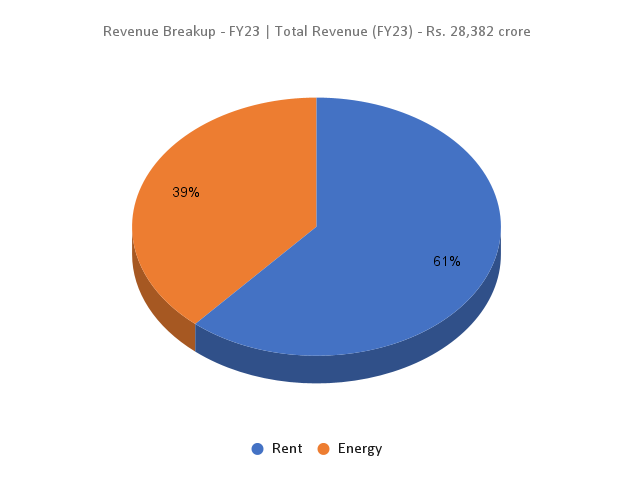

- Tower Options: Providing quite a lot of designs—from ground-based and rooftop towers to hybrid poles and monopoles—for mounting operator antennae at optimum heights.

- Energy Options: Guaranteeing uninterrupted vitality provide to telecom gear, together with sustainable vitality choices.

- House Options: Partnering with residential and business property house owners to accommodate telecom and energy gear wants.

Subsidiaries: As of FY23, Indus Towers has one subsidiary and no associates or joint ventures.

Progress Methods

- Marquee Consumer Base: Enlargement of market share amongst main Telecom Service Suppliers (TSPs) as a consequence of 5G deployment.

- Rural Enlargement: Ongoing rural enlargement efforts by main purchasers current alternatives for progress.

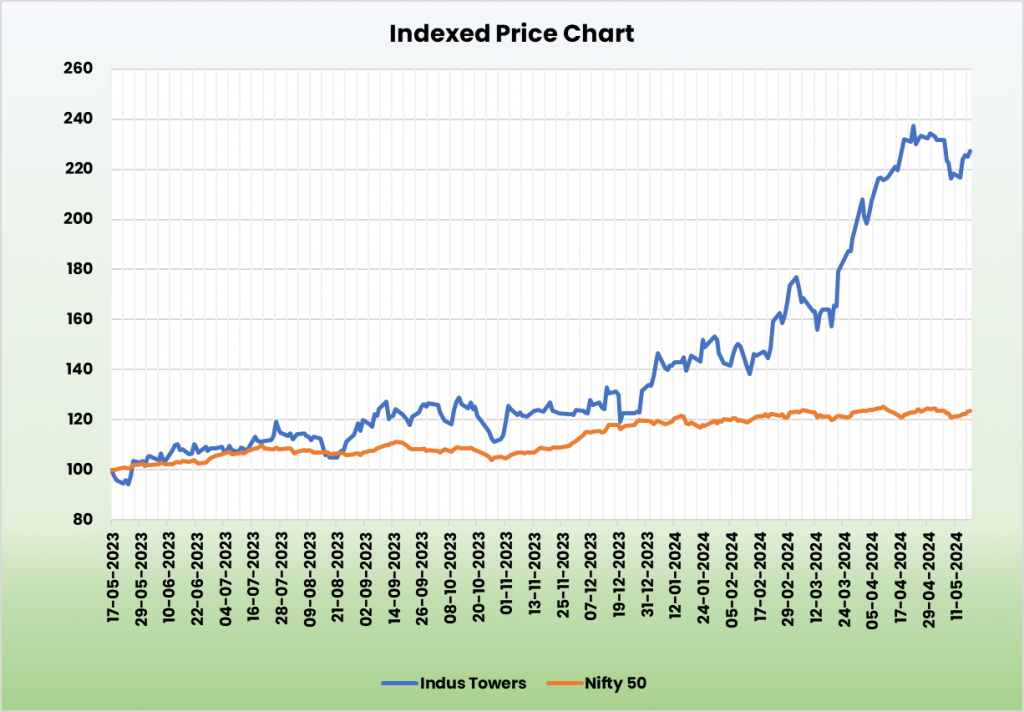

- Report Tower Additions: Achieved the best yearly tower additions in FY24, surpassing 200,000 towers.

- VIL Dues and Rollout: Maintained 100% assortment towards billing and made progress on previous dues assortment from Vodafone Concept Restricted (VIL).

Monetary Highlights

Q4FY24 Efficiency

- Income: Rs. 7,193 crore (up 7% YoY)

- Core Rental Income: Rs. 4,580 crore (up 7.7% YoY)

- Working Revenue: Rs. 4,072 crore (up 19% YoY)

- EBITDA Margin: 57% (up 6 share factors YoY)

- Web Revenue: Rs. 1,853 crore (up 32% YoY)

FY19-24 Monetary Efficiency

- Income and PAT CAGR: 33% and 22%

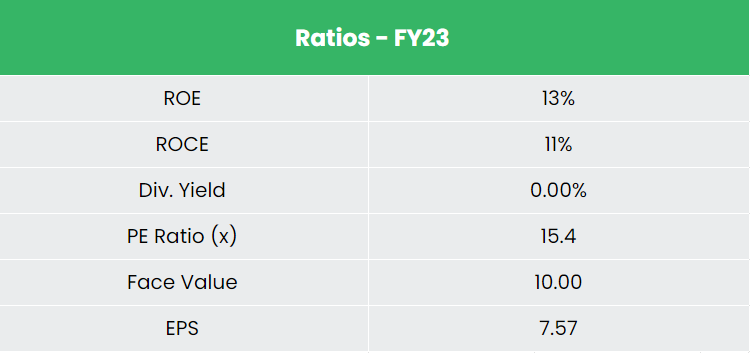

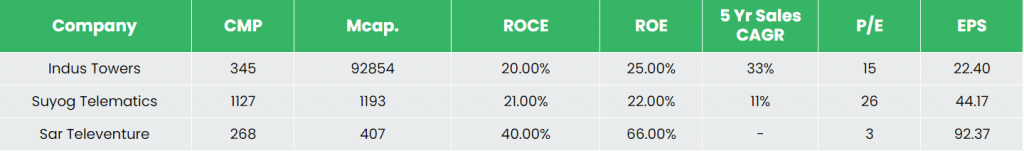

- ROE & ROCE: 22% and 20%

- Debt-to-Fairness Ratio: 0.76

Business Outlook

- Market Measurement: India is the second-largest telecom market with 1,190.33 million subscribers as of December 2023.

- Reasonably priced Tariffs and MNP: Wider availability and roll-out of Cellular Quantity Portability increase the market.

- Authorities Initiatives: Assist for digitization and conducive regulatory setting.

- Cellular Penetration: Anticipated addition of 500 million new web customers in 5 years.

- Tele-density: Total 85.69%, with rural at 59.19% and concrete at 133.72%.

Progress Drivers

- 100% FDI is now allowed within the telecom sector with the influx at US$ 39.31 billion between April 2000-December 2023.

- In Union Finances 2023-24, the Division of Telecommunications was allotted Rs. 97,579.05 crore (US$ 11.92 billion).

- India is aiming to fabricate cell phones value $126 Bn by 2025-26.

Aggressive Benefit

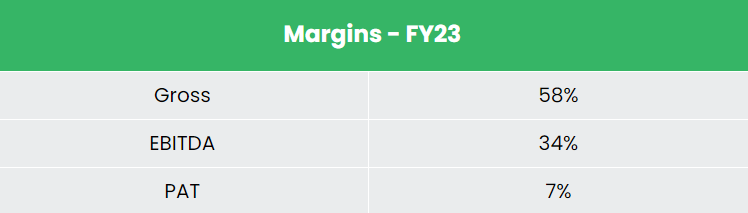

Indus Towers is probably the most undervalued inventory within the large-cap phase, constantly translating regular gross sales progress into increasing margins and earnings in comparison with rivals like Suyog Telematics Ltd and Sar Televenture Ltd.

Outlook

- Market Share Good points: Aiming to extend market share.

- Value Effectivity: Optimizing diesel consumption for price financial savings.

- Community Uptime: Guaranteeing excessive community uptime.

- Sustainability: Centered on sustainable practices.

- 5G Rollout: In depth 5G deployment resulting in elevated income streams.

- Progress Alternative: Positioned to capitalize on the intersection of heightened information utilization and speedy 5G adoption.

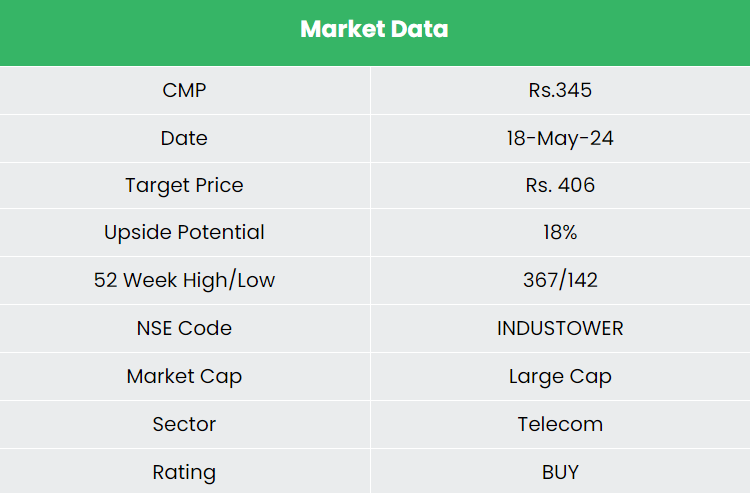

Valuation

The wholesome demand outlook for telecom infrastructure, pushed by sturdy information consumption, accelerated 5G rollouts, and gaps in 4G companies, positions Indus Towers effectively for progress. We suggest a BUY ranking within the inventory with the goal worth (TP) of Rs. 406, 14x FY26E EPS.

Dangers

- Monetary Stability of TSPs: Investments in 5G rollouts and spectrum acquisitions might pressure TSPs’ financials, affecting funds to Indus Towers.

- Contract Renewal Phrases: Unfavorable alterations to contract phrases with purchasers, resembling lowered pricing or escalations, pose dangers.

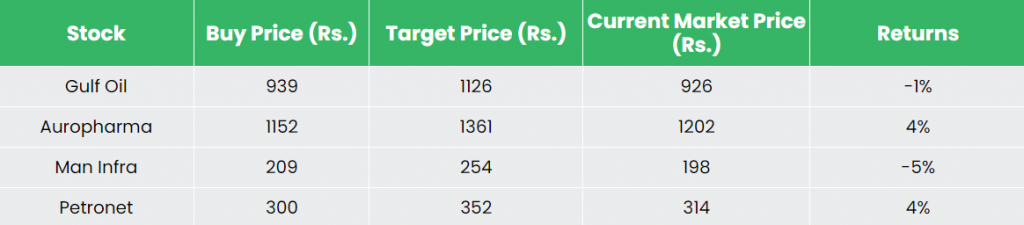

Recap of our earlier suggestions (As on 18 Might 2024)

Different articles chances are you’ll like

Put up Views:

414