As we speak, mortgage corporations are staring down an ideal storm that can impression their means to carry onto their market share. Demand for brand new mortgages is about to surge. Impending drops in rates of interest are going to gas demand in a approach that lenders and servicers are at the moment not ready to deal with. In January, we sat down with a CEO of a high originator who was anticipating a market flip however felt we had at the very least 12 months to gear up.

A number of weeks, rates of interest barely dipped and this identical lender was already feeling the stress of the rising market to return. . Their workforce was overextended, burning the candle at each ends simply to maintain up with a small uptick in demand.

Mortgage corporations identical to the one I spoke with are watching the storm gathering on the horizon and hoping to trip it out. These market shifts occur on a regular basis— rates of interest, residence gross sales, and mortgage demand rise after which fall, and this cycle continues. However we’re studying the market, and the message is obvious: this shift won’t be like every you’ve seen earlier than. Check out why this time round is completely different.

The Present Mortgage Panorama

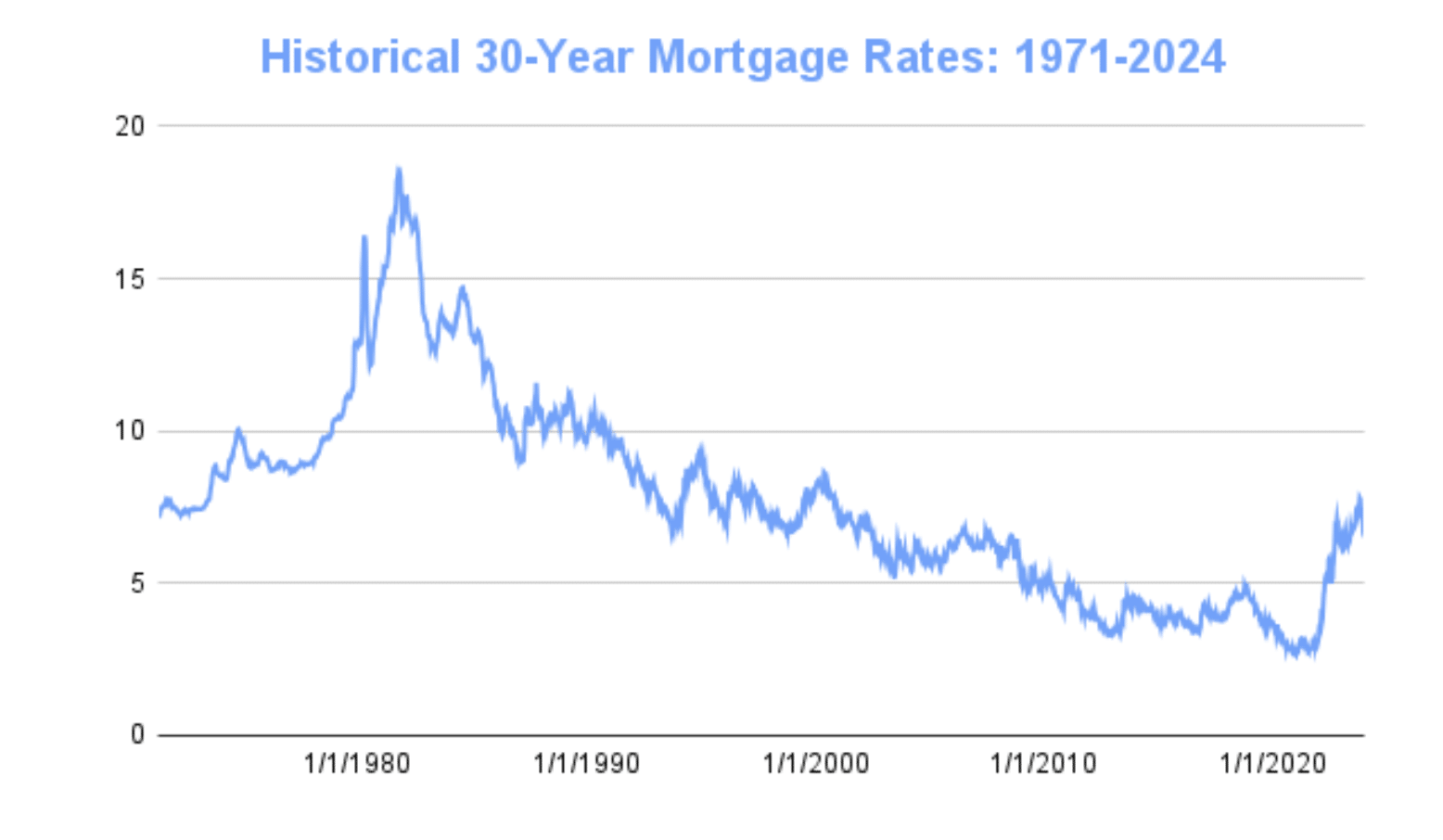

After report low mortgage charges and supersonic demand because of the pandemic, mortgage charges have elevated steadily these previous two years.

- The financial panorama has discovered its footing not too long ago, but it skilled important fluctuations ranging from 2020 up till mid-2023.

- The onset of the pandemic led to a drastic discount within the federal funds charge, all the way down to nil, which in flip sparked a surge within the housing market, sending property costs hovering. Subsequently, as inflation began to spiral, the Federal Reserve responded with a collection of 11 charge will increase.

- In the meantime, the typical 30-year mounted mortgage rate of interest went from 2.8% in late 2021 as much as a

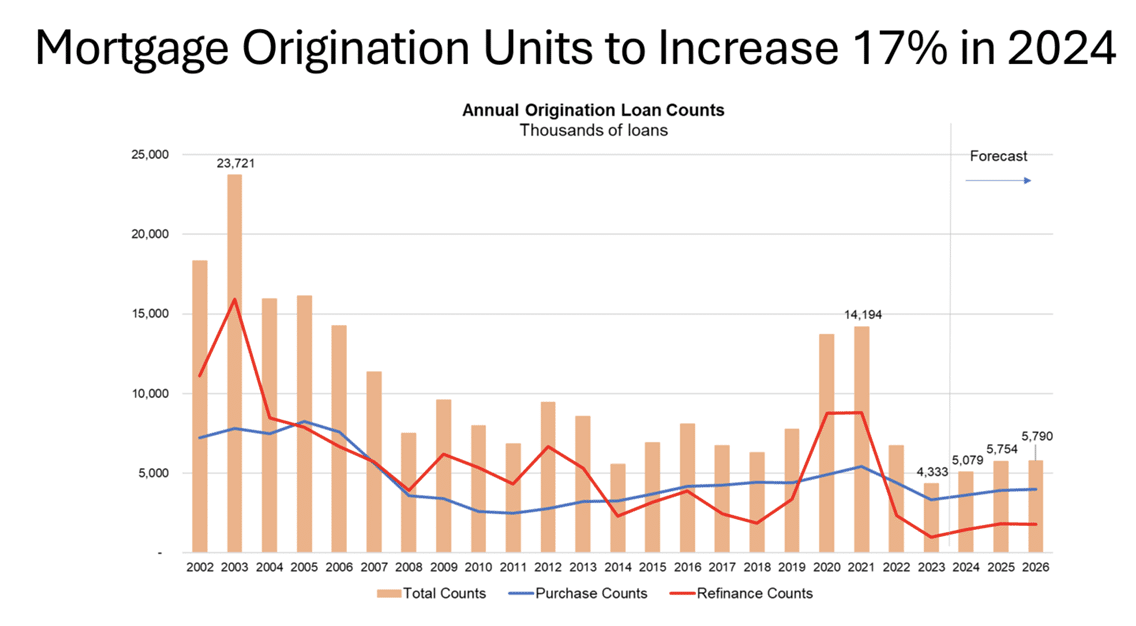

22-year excessive of seven.79% in October 2023. - Because of this, Mortgage originations have been lower in half from 2021 to 2022 and continued falling in 2023.

- From December onwards, there’s been a noticeable steadiness in mortgage charges, with a mild sway between 6.5% and seven%.

- Excessive mortgage charges, steep property costs, and a historic scarcity of accessible houses are persistent challenges. But whispers of potential Federal Reserve reductions have many pondering their impression on this equilibrium.

Economists are anticipating a number of charge cuts from the Federal Reserve. These cuts will broadly impression the mortgage origination and servicing market. Mortgage origination quantity is predicted to extend 23 % in 2024 to $2 trillion, with a 16 % enhance in buy and a 50 % enhance in refinance quantity,” based on the MBA’s Financial Commentary Archives | MBA.

As well as, the MBA famous: “We’re forecasting a 7 % enhance in present residence gross sales and a 14 % enhance in new residence gross sales in 2024. Coupled with ongoing, however slower, development in residence costs, this gross sales development 2 will help greater buy quantity.” Somewhat than a sudden spike, the present outlook is that mortgage quantity, in addition to refinance quantity, will progressively climb all year long.

An Outsized Impression

Though the rise and fall of the mortgage market occurs on a regular basis, this surge in demand goes to impression lenders and servicers disproportionately. It’s not simply rates of interest and rising demand that must be high of thoughts; it’s additionally how the world has utterly turned the other way up. And the speed and scale at which change occurs has by no means been extra pronounced.

We’re calling it now: the lenders who’re ready to navigate the shifting panorama are those who will nook the market.

The final time the lenders noticed a requirement surge, it was fueled by the bottom rates of interest in historical past. These charges drove refinance quantity by the roof in a single day, taking everybody unexpectedly. It was the quickest climb in demand within the shortest interval the business had ever skilled. Nobody noticed it coming and nobody was ready to seize it. This time round, it’s completely different.

The truth of the locked-up housing market – with low residence stock, record-high mortgage rates of interest, the bottom variety of residence gross sales in virtually 30 years, and intensely low mortgage and refinance quantity – led many corporations to take drastic motion. The downturn was in impact for such a very long time – with little hope of letting up – that many organizations have lower staffing to the bone. Mortgage professionals which have remained are getting ready to burnout.

Going through down the expertise scarcity

When mortgage quantity does start to rise, expertise points will develop into clear in a short time. Alongside the general enhance in quantity, there shall be a necessity for velocity. Since rates of interest have been so excessive for therefore lengthy, the incoming market shift will trigger a snowball impact. First-time homebuyers have been priced out of the marketplace for such an prolonged time period that they’re determined to lock in a house. Even minimal modifications in rates of interest are impacting residence shopping for exercise. On the identical time there aren’t sufficient houses for patrons coming into the market. So, when an keen homebuyer lastly finds a house, they want a mortgage quick. If the method slows down at any level, buyer satisfaction shall be impacted and firms danger shedding enterprise to opponents.

Sustaining distinctive service ranges shall be essential throughout this era.

In at present’s aggressive panorama, lenders who prioritize a frictionless shopper journey, characterised by swift underwriting selections and environment friendly closings, will stand out. The caliber of service supplied will develop into the important thing aggressive edge, as debtors gravitate in direction of lenders who assure a reliable and streamlined expertise.

Nevertheless, corporations which have calibrated their staffing to the present market calls for might quickly face operational bottlenecks. Provided that a person’s each day output has its limits, lenders might want to scale their workforce to uphold superior service requirements. Whereas this technique appears easy, it’s sophisticated by a number of elements. The extended business hunch has led to a big exodus of expert professionals. Because the market rebounds, the race to recruit expertise to deal with the inflow of mortgage functions will intensify. With a finite pool of certified candidates, securing top-tier expertise will develop into more and more difficult and dear.

Origination Prices

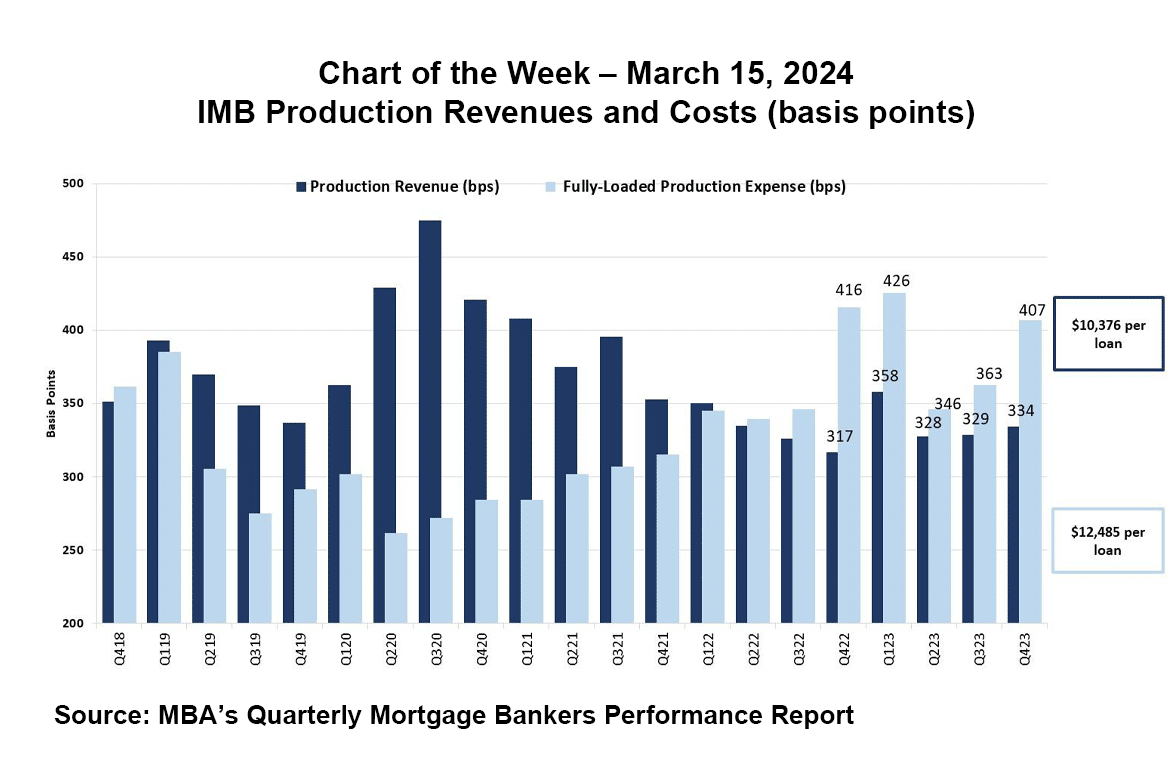

One other indicator of the rigidity of main mortgage gamers comes after we study the latest will increase in the price of mortgage origination. MBA information signifies that between 2008 and 2023, mortgage manufacturing bills averaged $7,236 per mortgage. Manufacturing prices within the fourth quarter of 2023 averaged $12,485 per mortgage, a rise of over $1,000 per mortgage from the third quarter. With prices greater than income for mortgage originators, based on the MBA, the tip of 2023 was the seventh consecutive quarter of internet manufacturing losses.

The MBA reviews: “The rise in manufacturing value, together with a concurrent lower in productiveness, displays extra capability and the problem that lenders face in adjusting assets to align with fluctuating charges and volumes.” What does this imply? Over the previous two years, main corporations have been unable to maintain tempo with the market downturn, regardless of makes an attempt to drastically slash prices and assets. We are able to safely say that over a number of months, corporations will equally wrestle to regulate to the market upturn, that means origination prices will proceed to extend whereas service ranges undergo.

On the servicing facet, lenders are intently monitoring the potential for elevated MSR runoffs as charges decline. Debtors who secured a mortgage in the previous couple of years whereas rates of interest have been peaking shall be longing for monetary reduction and can rush to make the most of stabilizing charges by refinancing. Past the manpower to deal with refinancing quantity, excessive mortgage origination prices, together with a possible surge in prepayments, make the refinancing spike costly for mortgage servicers. The danger of runoffs shall be high of thoughts for a lot of servicing leaders.

Don’t Simply Put together. Construct a New Working Mannequin.

There was one other important shift within the mortgage panorama for the reason that final main spike in mortgage and refinance demand – synthetic intelligence. The developments in generative AI, automation, and different digital companies are altering the best way that work is completed throughout all industries. The mortgage business is not any exception: AI has broad functions throughout the mortgage lifecycle, and the lenders that embrace these advances to construct scalable, technology-enabled working fashions are going to rapidly develop into standouts within the subject. These corporations will be capable of decrease the price of mortgage origination and develop into extra environment friendly.

In a latest dialog with a number one lender, I discovered they’re deliberately overstaffed, sustaining surplus capability to be primed for an upswing available in the market. This method, whereas cautious, is expensive and rooted in an outdated operational framework that doesn’t align with the trendy dynamics of the mortgage business. Equally, the push to recruit extra workers as demand will increase is a conventional tactic that might not be efficient in a reworked market panorama.

The answer for the long run isn’t merely to rent extra personnel; it’s about enhancing the productiveness of the workforce you have already got.

As we anticipate a surge in demand, the disparity between those that are ready and those that aren’t—particularly, between those that make the most of expertise to spice up their workforce’s capabilities and those that don’t—will develop into more and more pronounced. Some organizations will elevate their service ranges and capitalize on this second. In distinction, others will discover themselves scrambling to recruit, struggling to undertake new applied sciences, and striving to keep up cohesion—a mannequin that’s removed from viable in the long run. With the market progressively warming up and poised for development, adopting a forward-thinking technique now could be essential to maintain tempo with the evolving charge of change.

In our estimate, lower than 8% of lenders are outfitted with the technological and operational capabilities to handle the upcoming mortgage surge. Because of this those that are ready may have the chance to seize extra market share. For those who’re on the lookout for extra traits on operational readiness, e-mail me at [email protected]. For extra methods, maintain an eye fixed out for my subsequent weblog, “Alternative is Knocking: Shifting Technique to Seize the Market.”